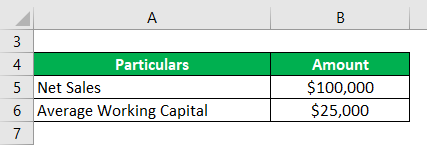

It is calculated by adding the beginning and ending total assets and dividing the sum by two. Average total assets are the average value of a company's total assets over a specific period, usually the fiscal year. Net sales refer to the total revenue generated by a company after deducting any sales returns, allowances, or discounts. The formula is as follows:Īsset Turnover Ratio = Net Sales / Average Total Assets A high asset turnover ratio suggests effective asset management, while a low ratio may indicate inefficiency or underutilization of assets.Ĭalculating Asset Turnover: The asset turnover ratio is calculated by dividing the net sales or revenue of a company by its average total assets. It indicates how efficiently a company is utilizing its assets to generate sales. What is Asset Turnover? Asset turnover is a financial ratio that measures a company's ability to generate sales revenue relative to its total assets.

In this article, we will delve into the concept of asset turnover, its calculation, significance, and how it can be used for financial analysis. It provides insights into how well a company utilizes its assets to generate sales revenue. Introduction: Asset turnover is a crucial financial metric used by businesses and investors to evaluate the efficiency and effectiveness of a company's asset management. It does not store any personal data.Understanding Asset Turnover: A Key Metric for Financial Analysis

The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. In the case of a lower value, you can probably assume that the business you’re analyzing isn’t being managed very effectively, or that it’s experiencing manufacturing or production difficulties that are impacting sales.Īs with many other efficiency ratios, it’s important to remember that there are varying industry standards for the asset turnover value.įor this reason, you should always make a point of comparing your results with other companies in the same industry. When the ratio value is very low, on the other hand, it tells you that a business has a lot of money invested in assets, but isn’t seeing a huge return on those assets in terms of revenue. When the ratio result is relatively high, it tells you that a company is using its resources in the most efficient manner possible to produce income. Generally speaking, a higher ratio is a more desirable outcome for most businesses. Okay now let's find out how the total asset turnover is used to evaluate a company's efficiency.Ī ratio of 1, or 100%, means that a firm is generating a dollar in sales for every dollar in assets that it owns.

0 kommentar(er)

0 kommentar(er)